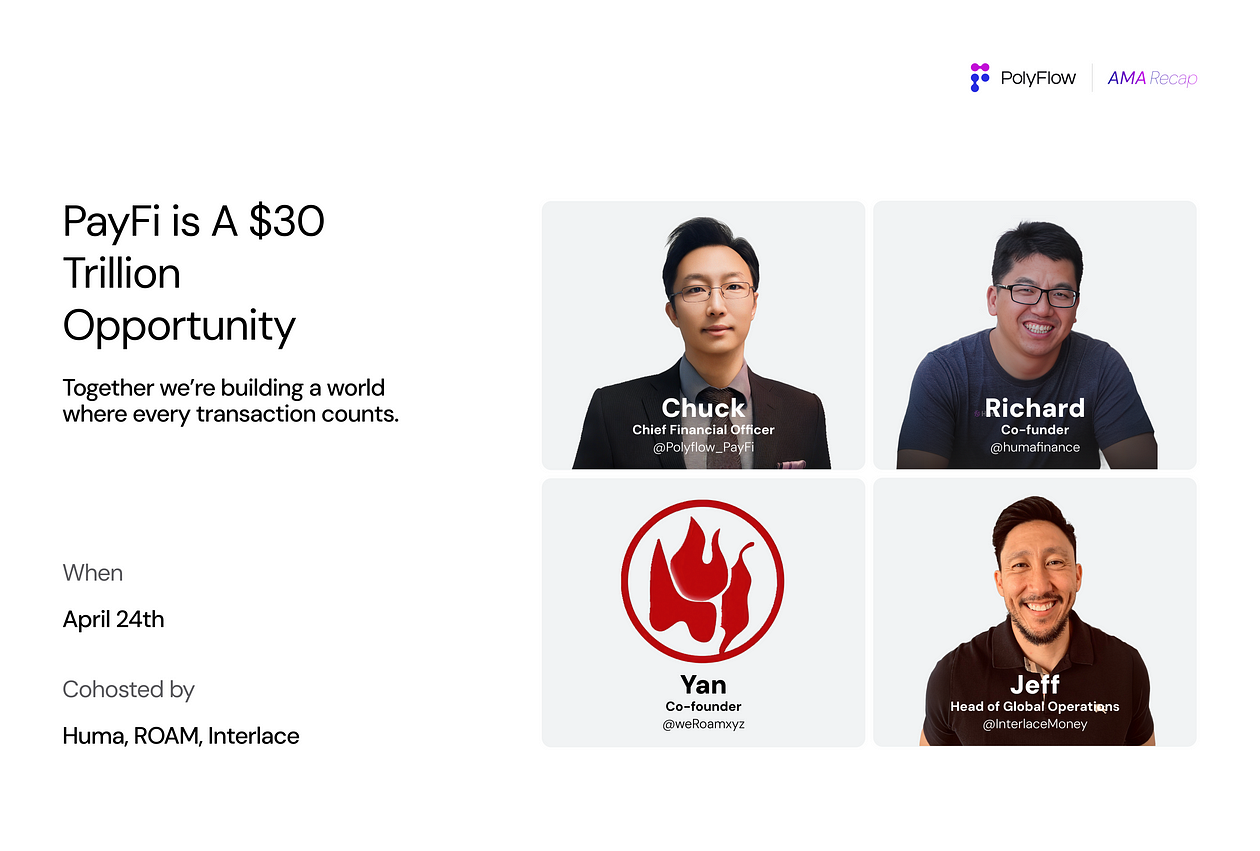

PolyFlow AMA: PayFi’s Global Rise with Huma, ROAM, and Interlace

On April 24, 2025, the PolyFlow community came together for a landmark AMA featuring pioneers in the PayFi ecosystem. Hosted by Chuck Zhang, CFO of PolyFlow, the session spotlighted how real-world payment innovation is unfolding across decentralized networks, telecommunications, and cross-border finance. Meet the Speakers * Dr. Richard Liu — Co-Founder of Huma, building infrastructure for global payment financing via blockchain. * Dr. Yan Zhang — Founder of ROAM, a decentralized global telc

On April 24, 2025, the PolyFlow community came together for a landmark AMA featuring pioneers in the PayFi ecosystem. Hosted by Chuck Zhang, CFO of PolyFlow, the session spotlighted how real-world payment innovation is unfolding across decentralized networks, telecommunications, and cross-border finance.

Meet the Speakers

- Dr. Richard Liu — Co-Founder of Huma, building infrastructure for global payment financing via blockchain.

- Dr. Yan Zhang — Founder of ROAM, a decentralized global telco network combining fintech and connectivity.

- Jeff Brunjes — Global Head of Operations at Interlace, a leading infrastructure for crypto card issuance.

What is PayFi? A $30 Trillion Opportunity

Richard kicked things off, calling PayFi “the next wave of financial innovation — leveraging blockchain to finance payments just like traditional banks do with credit cards or trade finance.”

“When you swipe your credit card, you don’t pay immediately — the bank fronts it. That’s payment financing. PayFi brings this logic to the blockchain.” — Richard Liu

He noted that payment financing already exists at scale (e.g. credit cards, supply chain pre-funding) but suffers from high fees and delays. By embedding liquidity into blockchain rails, Huma has already processed over $4B in transactions, offering near-instant settlement.

Jeff zoomed into Interlace’s role: enabling enterprises to make and receive stablecoin-based payments globally. “Legacy systems require multiple banks, delays, and clearing steps. We automate that with blockchain to achieve near-instant confirmations.”

Yan positioned PayFi as the missing layer between DePIN infrastructure and user services. ROAM, which already boasts 2 million users, is building a global telco wallet where users earn rewards and access services by staking ROAM tokens. “We connect people. Now we want to serve them — and that means payments.”

How Each Project is Transforming the Space

Huma

Huma is pioneering T+0 (same-day) settlements for merchants and cross-border transfers, bypassing the days-long timelines of Swift. Richard shared how this delivers real yield:

“Just by accelerating payment flows, we can generate a 15–25% APR from healthy, low-risk opportunities that were previously inaccessible to retail users.”

Huma also launched the PayFi Strategy Token (PST), which packages yield-bearing strategies into a tokenized asset that integrates across Solana’s DeFi stack.

Tactics for Growth:

- Focused expansion in low-risk sectors like cross-border pre-funding and merchant settlements.

- Exclusive work with licensed financial institutions in highly regulated markets (U.S., UK, Singapore, UAE).

- Aiming to scale to $10B in transactions by end of 2025, with a long-term goal of $100B volume.

- Hosting PayFi Summits with Solana Foundation to shape industry consensus and visibility.

Interlace

Jeff explained how Interlace serves two markets:

- Enterprise partners using Interlace’s Cards-as-a-Service and Wallet-as-a-Service for fast, compliant payments.

- Direct clients looking for bank-like services with crypto capabilities (e.g. card issuance, fiat/crypto wallets).

“We leverage our global bank fiat accounts in multiple currencies wrapped up in a regulatory compliant process to reduce compliance and settlement costs while giving Web3 businesses Apple Pay-level usability.”

Tactics for Growth:

- Expanding from Asia to a global client base across LATAM, Europe, and Africa.

- Adding BINs and banking partners to cover diverse regulatory geographies.

- Building out compliance layers with KYT, KYC, and third-party verifications.

- Offering modular API solutions for businesses to launch crypto-native financial products quickly.

ROAM

ROAM is a DePIN (Decentralized Physical Infrastructure Network) project aiming to integrate telecom and payments. Yan emphasized their unique model:

“Most DePIN miners purchaser expect 3–6 months pay back of their miner, which equates to 2–300% yields — that’s not sustainable. ROAM is different. Our tokens are used to buy real services: global telco access, eSIMs, and soon, credit cards.”

ROAM is focused on providing services in terms of payments to add value. It then plans to use user behavior data (while preserving privacy) to power future lending services and credit scoring, effectively merging telco and PayFi.

Tactics for Growth:

- Launching ROAM credit cards and integrating token staking for real-world services.

- Building a privacy-preserving behavioral dataset to enable consumer credit and lending services.

- Targeting 10 million active users by building around actual utility, not speculation.

- Partnering with other Web3 platforms (e.g. Huma, PolyFlow) for co-distribution and user acquisition.

Regulation and Risk

Cross-border compliance is a major hurdle. Jeff highlighted Interlace’s robust KYT (Know-Your-Transaction) and KYC layers, noting partnerships across Asia, Europe, and LATAM. Richard explained that Huma works only with licensed institutions in developed markets and integrates tools like Chainalysis to prevent illicit flows.

Looking Ahead: Predictions for 2025 and Beyond

- Yan Zhang: “ROAM aims to reach 10M users and prove that decentralized telco+PayFi is a viable global business model.”

- Jeff Brunjes: “Stablecoins will become standard for business transactions. Builders today are laying the rails for the next financial system.”

- Richard Liu: “Within 5 years, T+0 payments will account for over 30% of global settlement volume.”

“the entire crypto industry should all look more into total transaction volume instead of total vanity leaderboard which is tvl. We should measure DeFi by transaction value, not locked capital.” — Richard Liu

Conclusion: PayFi is Here

The AMA reinforced that PayFi is not a niche concept — it’s a foundational upgrade to how the world moves money. From yield generation to inclusion, compliance to consumer access, this sector is rapidly maturing.

As Chuck put it:

“Together we’re building a world where every transaction counts. PayFi and Prosperity.”

Follow @PolyFlow_PayFi to stay at the forefront of decentralized payments.

SOCIALS

To find out more about PolyFlow and keep up with our latest developments, follow the official channels.

🎮 DAPP | 💬 Global Community | 👾 Discord| 🐦 Twitter/X | 🌐 Website

CONTACT US

support@polyflow.tech

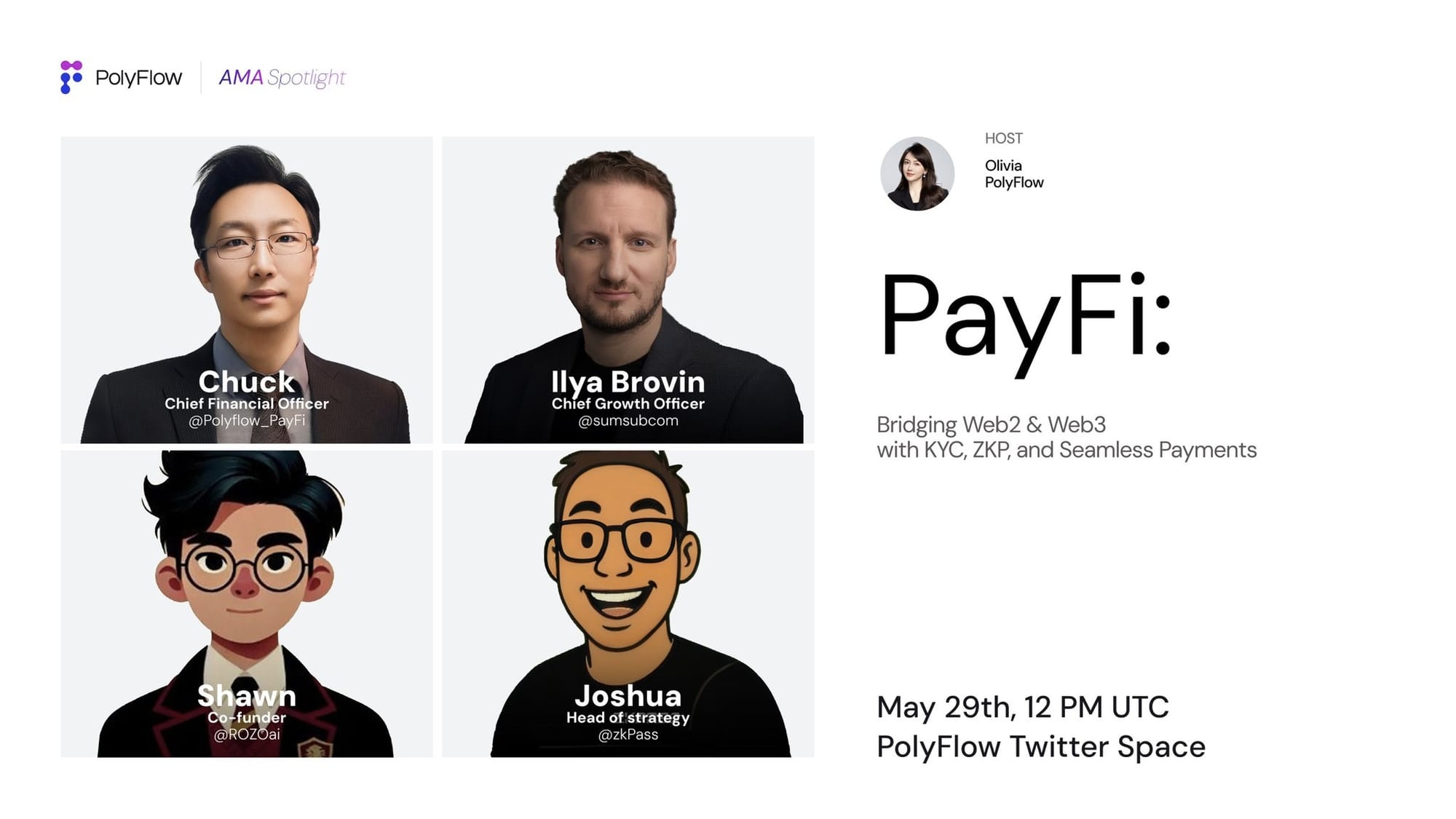

PolyFlow AMA: PayFi, Privacy, and the Path Forward

Recap: https://x.com/i/spaces/1vOxwXNNjqdKB/peek Participants: Joshua (ZKPass), Ilya (Sumsub), Shawn (Rozo Labs), Chuck (PolyFlow) Host: Olivia (PolyFlow) In this edition of PolyFlow’s PayFi Spotlight, top minds from identity, payments, and privacy infrastructure gathered to explore one of Web3’s most urgent frontiers: how to build compliant, user-friendly payment rails that connect Web2 and Web3 without compromising privacy or user experience. Hosted by Olivia in NYC, the conversation delve

PolyFlow AMA: PayFi’s Global Rise with Huma, ROAM, and Interlace

On April 24, 2025, the PolyFlow community came together for a landmark AMA featuring pioneers in the PayFi ecosystem. Hosted by Chuck Zhang, CFO of PolyFlow, the session spotlighted how real-world payment innovation is unfolding across decentralized networks, telecommunications, and cross-border finance. Meet the Speakers * Dr. Richard Liu — Co-Founder of Huma, building infrastructure for global payment financing via blockchain. * Dr. Yan Zhang — Founder of ROAM, a decentralized global telc

PolyFlow AMA PayFi Spotlight | The Future of RWA Tokenization

The PolyFlow team recently hosted an insightful AMA featuring top experts in the Real-World Asset (RWA) tokenization space. Moderated by Chuck, CFO of PolyFlow, the discussion delved into the evolving RWA landscape, regulatory challenges, and the potential for mass adoption. The panel included: * Daisy — RWA Solution Architect at Zan, specializing in enabling Web3 projects through tokenized real-world assets. * Tony — Co-founder of RWA Ltd (formerly NFT China), a leading NFT trading platform