PolyFlow AMA: PayFi, Privacy, and the Path Forward

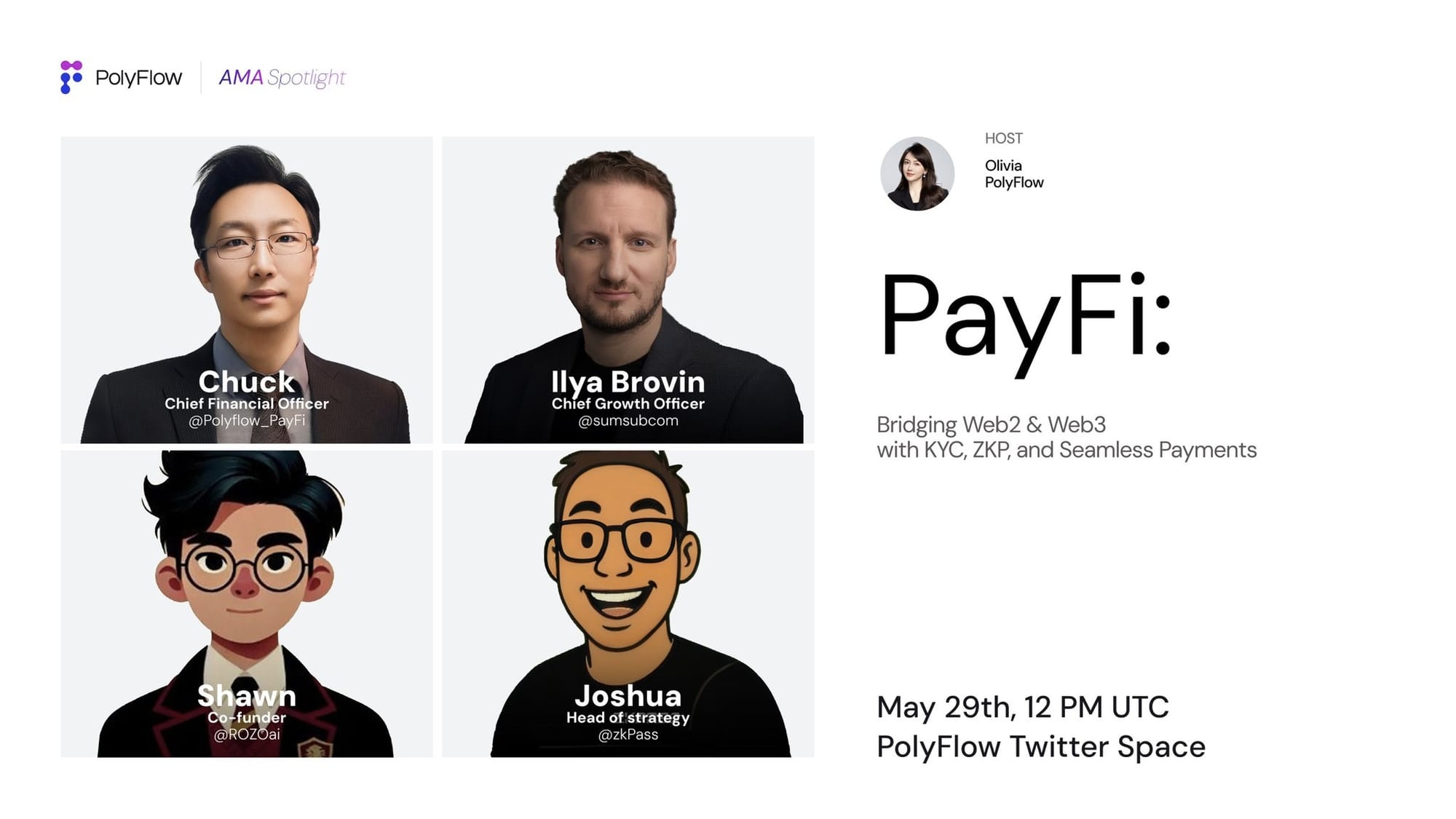

Recap: https://x.com/i/spaces/1vOxwXNNjqdKB/peek Participants: Joshua (ZKPass), Ilya (Sumsub), Shawn (Rozo Labs), Chuck (PolyFlow) Host: Olivia (PolyFlow) In this edition of PolyFlow’s PayFi Spotlight, top minds from identity, payments, and privacy infrastructure gathered to explore one of Web3’s most urgent frontiers: how to build compliant, user-friendly payment rails that connect Web2 and Web3 without compromising privacy or user experience. Hosted by Olivia in NYC, the conversation delve

Recap: https://x.com/i/spaces/1vOxwXNNjqdKB/peek

Participants: Joshua (ZKPass), Ilya (Sumsub), Shawn (Rozo Labs), Chuck (PolyFlow)

Host: Olivia (PolyFlow)

In this edition of PolyFlow’s PayFi Spotlight, top minds from identity, payments, and privacy infrastructure gathered to explore one of Web3’s most urgent frontiers: how to build compliant, user-friendly payment rails that connect Web2 and Web3 without compromising privacy or user experience.

Hosted by Olivia in NYC, the conversation delved into reusable identity systems, zero-knowledge proofs, decentralized payment IDs, and the future of compliance in an increasingly regulated crypto landscape.

Why PayFi Now?

As Olivia opened the session, she underscored PayFi’s mission: to bring seamless payments, strong compliance, and private identity into the Web3 mainstream.

Each guest brought a unique perspective:

Joshua from ZKPass described his company as a “private data oracle,” helping users verify off-chain account data on-chain without exposing personal details.

Ilya Brovin from Sumsub, one of Web3’s most trusted KYC providers, detailed new tools for reusing identity credentials across apps.

Shawn from Rozo Labs explained how his team is building privacy-first, offline-friendly eCash for Web3.

Chuck Zhang from PolyFlow walked through how the company’s new Payment ID (PID) enables compliant, efficient identity workflows.

The Rise of Reusable Identity

KYC remains a thorny issue for both users and platforms, often requiring repeated document uploads and identity checks. Sumsub’s new approach — Sumsub ID — allows users to store verified credentials for reuse, cutting onboarding time and friction across platforms.

This “KYC once, reuse often” model was seen as a practical bridge between strict compliance requirements and modern UX demands.

“We’re not just improving KYC — we’re making it reusable while keeping the legal meaning intact,” said Ilya.

The credentials can also issue on-chain attestations for use in dApps, wallets, or DeFi protocols — adding modularity to compliance.

ZKPass and the Power of Private Data

ZKPass introduced a compelling angle: bringing Web2 financial data on-chain via zero-knowledge transport layer security (ZK-TLS).

Instead of APIs or data-sharing agreements, ZKPass lets users prove facts — like their credit score or bank deposits — without revealing raw data. This unlocks new DeFi and PayFi use cases, such as credit-based lending or nationality verification for regulatory compliance.

“With ZK-TLS, users can prove they have $10K in a U.S. bank account or a 700+ credit score — without exposing the actual account,” Joshua explained.

This model reimagines what on-chain identity can look like: composable, decentralized, and privacy-preserving.

PolyFlow PID: A Wallet for Identity

PolyFlow’s Payment ID (PID) product complements both Sumsub and ZKPass by acting as an aggregation layer. Chuck described it as a “Web3 wallet for your identity” — a single container for digital credentials, purchase history, and reputation signals.

The PID integrates with Sumsub for verified identity and ZKPass for private data attestations, giving users control while improving trust for counterparties.

Importantly, PID also introduces monetization: users can share anonymized data with merchants and advertisers — on their terms — and receive revenue in return.

“If someone wants to advertise to you based on your PID-linked behavior, you get a piece of that, revenue” Chuck noted.

Rozo Labs and the Case for eCash

Rozo Labs presented their vision for a crypto-native eCash system: private, instant, and usable even when offline.

Shawn pointed out that blockchain’s transparency is both a strength and a flaw when it comes to privacy. He argued that the ability to pay without exposing transaction history is vital for adoption.

“Right now, people can track everything Vitalik.eth does on-chain. That’s a privacy crisis,” Shawn emphasized.

The eCash system also aims to support payments without needing an internet connection — mirroring the simplicity of tap-and-pay cards.

Compliance: Centralized Burden, Decentralized Future?

The final segment tackled compliance, where perspectives diverged. Ilya reminded the audience that today’s regulations are designed to outsource compliance to platforms — a model unlikely to change soon.

“Governments rely on regulated agents to handle KYC. That’s not going away,” he said bluntly.

Shawn proposed a more radical future: one where users KYC once — via government-backed ZK credentials — and authorize access selectively. While others agreed the idea was aspirational, they cautioned it may only emerge in underregulated or emerging markets.

Chuck noted a middle ground: in places like the U.S., rules are tightening, especially around stablecoins. But in regions like Latin America or Africa, where crypto adoption is high, new compliance models may flourish.

Final Thoughts

This AMA reinforced a few core themes:

Identity is foundational to PayFi — and it’s evolving fast through ZKPs, reusable IDs, and decentralized data ownership.

Privacy and compliance aren’t mutually exclusive — but bridging them requires better tools and coordination.

Mass adoption hinges on user experience — frictionless onboarding, intuitive wallets, and seamless payments will drive growth.

PolyFlow’s PID is emerging as a central piece in this stack — acting as both a container for credentials and a gateway for compliant interaction across the decentralized web.

Want to explore PayFi in action?

Try out our Scan-to-Earn program and follow us @PolyFlow_PayFi for updates. Together, we’re building a world where every transaction counts

SOCIALS

To find out more about PolyFlow and keep up with our latest developments, follow the official channels.

🎮 DAPP | 💬 Global Community | 👾 Discord| 🐦 Twitter/X | 🌐 Website

CONTACT US

support@polyflow.tech

PolyFlow AMA: PayFi, Privacy, and the Path Forward

Recap: https://x.com/i/spaces/1vOxwXNNjqdKB/peek Participants: Joshua (ZKPass), Ilya (Sumsub), Shawn (Rozo Labs), Chuck (PolyFlow) Host: Olivia (PolyFlow) In this edition of PolyFlow’s PayFi Spotlight, top minds from identity, payments, and privacy infrastructure gathered to explore one of Web3’s most urgent frontiers: how to build compliant, user-friendly payment rails that connect Web2 and Web3 without compromising privacy or user experience. Hosted by Olivia in NYC, the conversation delve

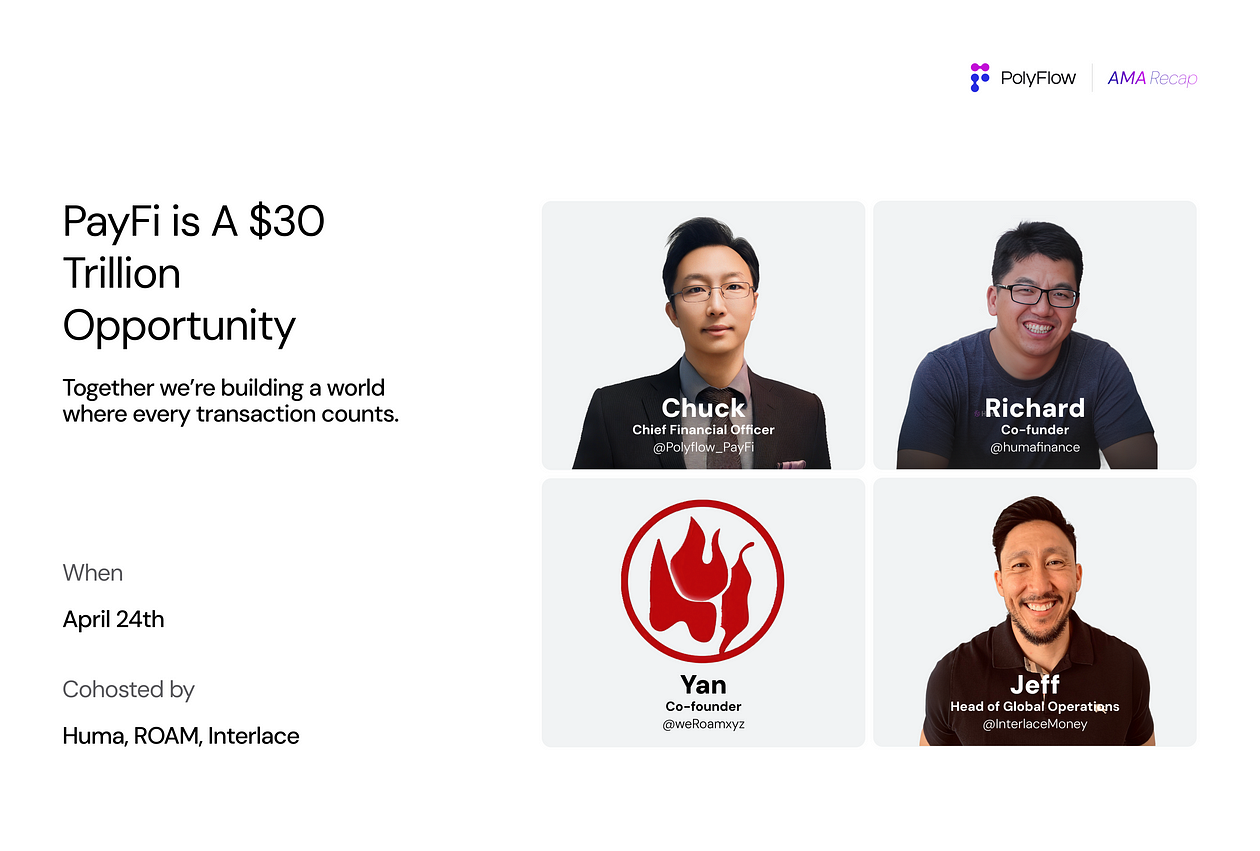

PolyFlow AMA: PayFi’s Global Rise with Huma, ROAM, and Interlace

On April 24, 2025, the PolyFlow community came together for a landmark AMA featuring pioneers in the PayFi ecosystem. Hosted by Chuck Zhang, CFO of PolyFlow, the session spotlighted how real-world payment innovation is unfolding across decentralized networks, telecommunications, and cross-border finance. Meet the Speakers * Dr. Richard Liu — Co-Founder of Huma, building infrastructure for global payment financing via blockchain. * Dr. Yan Zhang — Founder of ROAM, a decentralized global telc

PolyFlow AMA PayFi Spotlight | The Future of RWA Tokenization

The PolyFlow team recently hosted an insightful AMA featuring top experts in the Real-World Asset (RWA) tokenization space. Moderated by Chuck, CFO of PolyFlow, the discussion delved into the evolving RWA landscape, regulatory challenges, and the potential for mass adoption. The panel included: * Daisy — RWA Solution Architect at Zan, specializing in enabling Web3 projects through tokenized real-world assets. * Tony — Co-founder of RWA Ltd (formerly NFT China), a leading NFT trading platform