Decoding the US Stablecoin Act: Industry Leaders on Reshaping Crypto’s Future

On May 23rd, PolyFlow hosted a Special Asia AMA dissecting the implications of the U.S. Stablecoin Act (officially the “GENIUS Act”). Against the backdrop of Bitcoin reaching an unprecedented $110K, this landmark legislation signals crypto’s accelerating integration into traditional finance — a pivotal step in global financial transformation. Four industry pioneers convened to explore the bill’s profound impact and emerging opportunities. Recap https://x.com/Polyflow_PayFi/status/192589685089

On May 23rd, PolyFlow hosted a Special Asia AMA dissecting the implications of the U.S. Stablecoin Act (officially the “GENIUS Act”). Against the backdrop of Bitcoin reaching an unprecedented $110K, this landmark legislation signals crypto’s accelerating integration into traditional finance — a pivotal step in global financial transformation. Four industry pioneers convened to explore the bill’s profound impact and emerging opportunities.

Recap

https://x.com/Polyflow_PayFi/status/1925896850898337921

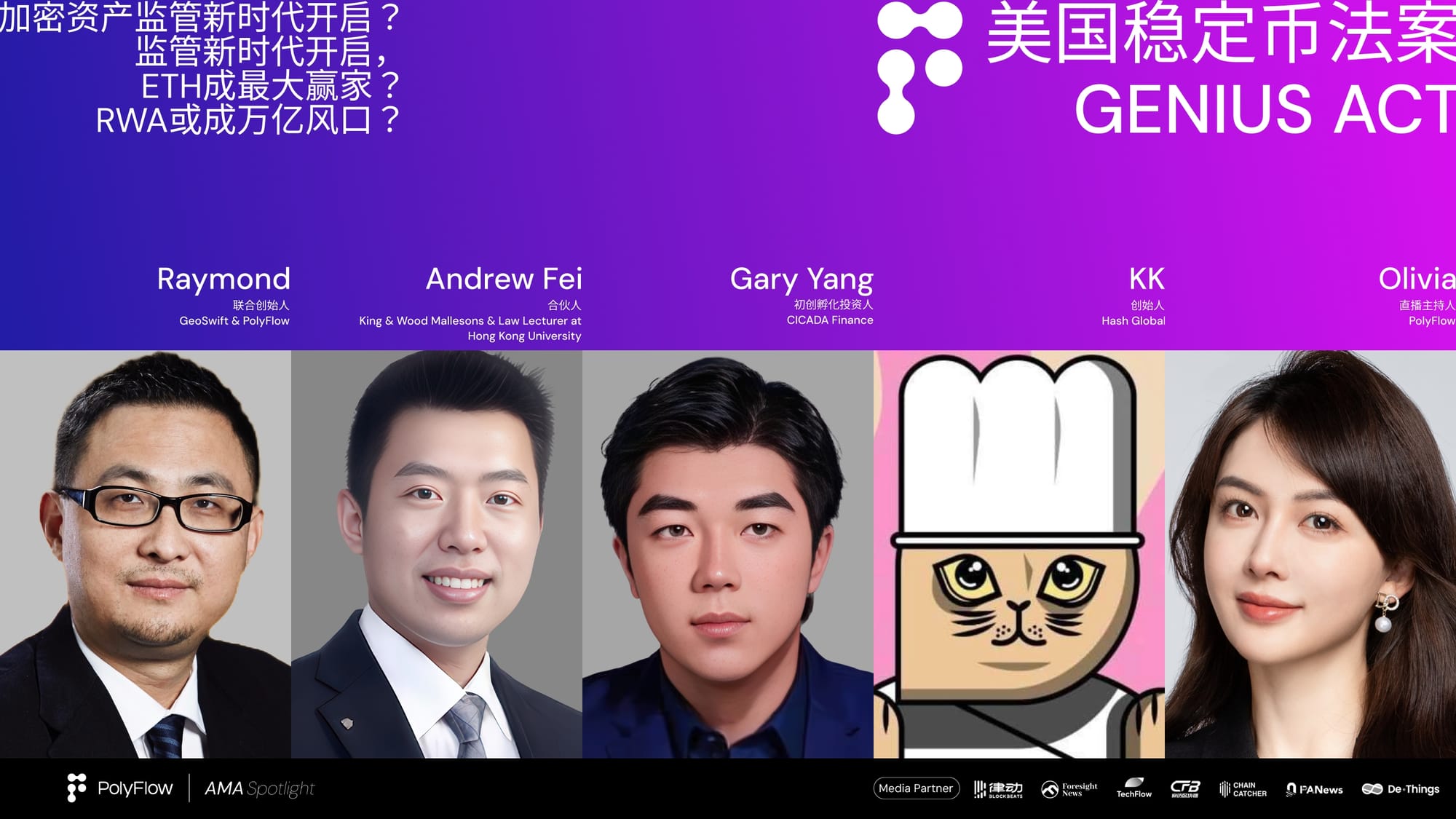

Meet the Speakers: Industry Vanguard

Raymond

Founder of cross-border payment firm GeoSwift, PolyFlow Co-Founder, and crypto pioneer. Raymond began Bitcoin investing in 2011, was an early Ripple investor, and witnessed crypto’s evolution to a trillion-dollar market. Expertise: cross-border payments and stablecoin implementation.

Andrew

Partner at King & Wood Mallesons (Hong Kong), U.S.-qualified attorney, and Adjunct Professor at HKU Faculty of Law. Specializes in digital assets, structured finance, syndicated loans, financial regulation, and securities law. Deeply engaged in U.S.-Asia financial policy research.

Gary

Investor at CICADA Finance and seasoned traditional VC/PE turned crypto practitioner. 15+ years in investment, driving asset management’s shift toward on-chain protocols. Focus: DeFi and RWA.

KK

Founder of Hash Global and early-stage crypto investor. Concentrates on stablecoins and payments, having led investments in 80+ Web3 projects. Advocate for technology-commercial integration.

The GENIUS Act: Framework & Implications

Attorney Andrew outlined the bill’s core provisions:

- Objective: Establish a comprehensive U.S. legal/regulatory framework for stablecoin adoption.

- Stablecoin Definition: Digital assets pegged 1:1 to fiat currency, serving as payment/settlement bridges between crypto and traditional finance.

- Dual Regulatory Structure:

- Issuers under $10B: State-regulated

- Larger issuers: Federally supervised (Federal Reserve, OCC, FDIC)

- Licensing Mandate: Only licensed entities may issue payment stablecoins in the U.S. Non-compliant foreign issuers barred from serving U.S. persons.

- Reserve & Transparency Rules:

- 100% qualified reserves (cash/government bonds)

- Monthly reserve audits + CEO/CFO attestations

- Accounting treatment as cash equivalents

- Compliance: AML/CFT, sanctions screening, and KYC enforcement. All issuers must enable lawful government intervention.

Key Takeaway:

The Act legitimizes stablecoins while prioritizing stability and security, catalyzing broader financial integration and setting a global precedent.

Stablecoins: Evolution & Market Confidence

Raymond contextualized stablecoins’ historical development:

- Pre-Stablecoin Era (2010–2013): Bitcoin’s volatility limited its payment utility despite early merchant adoption.

- 1:1 Stablecoin: Fiat-collateralized coins (USDT/USDC) emerged with 1:1 dollar backing.

- Leveraged Stablecoin 2.0: Crypto-collateralized models (e.g., DAI) introduced >100% collateralization.

- Algorithmic Experimentation: Failed models (e.g., UST) revealed the criticality of asset-backed stability.

The GENIUS Act’s Core Value:

Mandating 1:1 fiat reserves eliminates conceptual ambiguity and reinforces market confidence — the bedrock of crypto’s $4T growth.

Policy Drivers: Dollar Strategy in Transition

Gary analyzed the geopolitical underpinnings:

- Expanding Dollar Influence: The Act incentivizes global entities to issue dollar-pegged stablecoins using U.S. reserves — effectively outsourcing monetary expansion while extending dollar hegemony.

- Eroding Control: Dollar dominance has declined since 2019 due to:

- 40% USD overissuance and inflation

- Proliferation of alternative settlement systems (e.g., Hong Kong’s M-Bridge)

- Surging crypto-based settlements (Nigeria: >50% population; LatAm trade corridors: 5–15% YoY growth)

- Strategic Pivot: By embracing “restaking”-style economics (using U.S. debt as collateral for global “shadow money”), the U.S. leverages DeFi principles to reclaim monetary relevance.

Outlook:

Short-term volatility will precede long-term institutional realignment, with Hong Kong/Singapore poised to capitalize.

Market Impact: Convergence & Opportunity

KK (Investor Lens)

- Stablecoins represent “dollar RWA” — the foundational liquidity layer for Web3.

- Legislation accelerates institutional adoption (Visa/Mastercard integration) and attracts chain-bound capital.

- Issuance parallels credit card economics: revenue via payment network participation.

Raymond (Payment Infrastructure)

- Traditional-crypto antagonism is fading. Key developments:

- Ripple’s XRP-fiat bridges

- Circle’s CPN network

- Visa/PolyFlow cross-border pilots

- Regulatory clarity unlocks solutions for legitimate asset mobility.

Gary (Systemic Transformation)

- Banks will evolve into “compliant L1s,” issuing tokenized assets and stablecoins.

- JPMorgan, Citi, and Goldman’s blockchain adoption foreshadows deeper integration.

- Global jurisdictions (Japan, UAE, Singapore) will mirror U.S. frameworks — first-movers gain advantage.

Conclusion: The GENIUS Inflection Point

This legislation transcends stablecoin regulation — it re-architects financial plumbing. By bridging TradFi reliability with crypto efficiency, the Act positions the U.S. to harness decentralized finance while recalibrating dollar sovereignty. As banks become chain-native issuers and Asia accelerates adoption, a multi-trillion-dollar recalibration has begun.

Follow PolyFlow for insights at the payment-crypto frontier.

SOCIALS

To find out more about PolyFlow and keep up with our latest developments, follow the official channels.

🎮 DAPP | 💬 Global Community | 👾 Discord| 🐦 Twitter/X | 🌐 Website

CONTACT US

support@polyflow.tech